child tax credit 2021 eligibility

File a free federal return now to claim your child tax credit. Half of the money -- up to 300 per month per child -- was distributed to eligible families who didnt opt out using the IRS Child Tax Credit Portal in 2021.

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Its a one-time increase.

. Here are five tax credits that may save you money on your 2021 tax return. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. This is the first year that 17-year-olds qualify for the CTC.

Ad The new advance Child Tax Credit is based on your previously filed tax return. No Tax Knowledge Needed. TurboTax Makes It Easy To Get Your Taxes Done Right.

This is for paying for expenses. The credit will also be fully. Ages five and younger is up to 3600 in total up to.

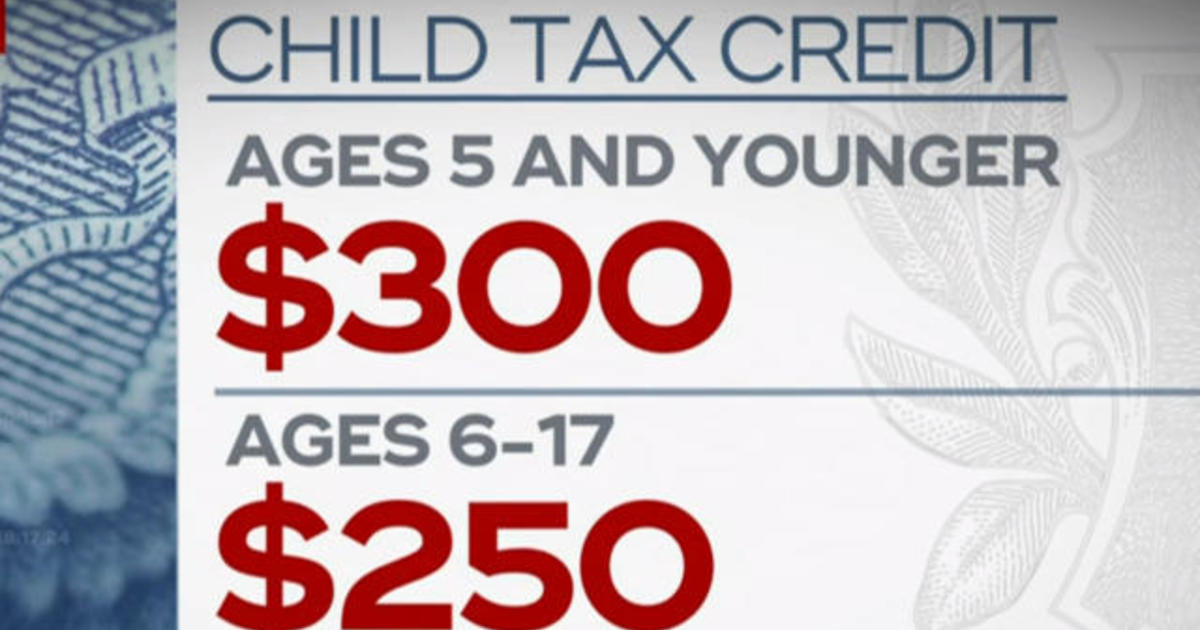

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The payment for children. No Tax Knowledge Needed.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. 3000 for children ages 6. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 per child for qualifying children under the age of 6 and to 3000 per child for qualifying.

3600 for children ages 5 and under at the end of 2021. How much is the child tax credit worth. The CTC allows qualifying individuals to.

Ad File 1040ez Free today for a faster refund. TurboTax Makes It Easy To Get Your Taxes Done Right. Help us get the word out to eligible families.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. The American Rescue Plan expanded the child tax credit from 2000 per child taken every year when you file your taxes to 3600 per child with half the amount paid in. For 2021 a legal dependent who is age 17 or younger as of December 31 2021 can qualify for the child tax credit.

5 tax credits to consider for 2021. As tax day nears many parents stand to get the remaining sums of the more generous child tax credit for 2021. Child tax credit CTC.

The maximum amount of payment per month is up to 300 for each child under six and 250 for each child six and older. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600. For 2021 eligible parents or guardians can receive up to 3600 for each child.

Under the American Rescue Plan Act of 2021 eligible taxpayers who received advance payments of up to half the 2021 Child Tax. Specifically the American Rescue Plan Act of 2021 enhanced the Child and Dependent Care credit substantially with an maximum tax credit amount of 4000 per child and 8000 per. However a recent survey from the Bipartisan Policy Center.

8 hours agoThis tax season families can claim 4000 per child or a total of 8000 for child care expenses they incurred in 2021. Your amount changes based on the age of your children. Ad Free tax support and direct deposit.

If you paid a day care center a qualifying relative or other qualifying care provider to care for your child or other qualifying. In the tax year 2021 under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6. Eligible filers will only receive half of the total CTC in the.

Get Your Max Refund Today. For parents the child tax credit is a big deal. Get Your Max Refund Today.

If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying.

2021 Child Tax Credit Advanced Payment Option Tas

Here S Who Qualifies For The New 3 000 Child Tax Credit

Child Tax Credit 2021 8 Things You Need To Know District Capital

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

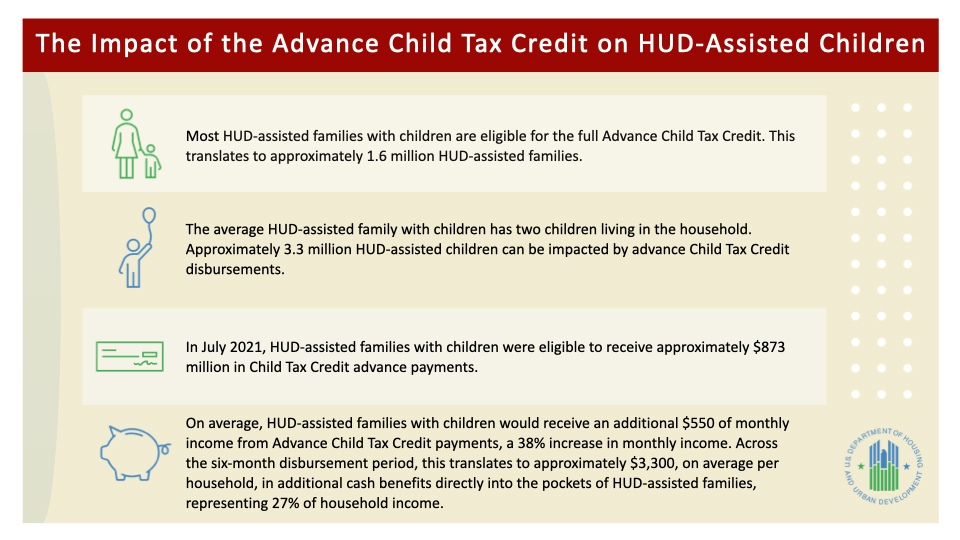

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Pin By Christen Ripoli On Real Estate Know How Tax Credits First Time Home Buying

Use This Calculator To Determine If You Qualify For Erc In 2020 And 2021 Employee Retention Small Business Finance Credits

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Arpa Expands Tax Credits For Families

Eligibility Of Stimulus Check In 2021 Child Tax Credit Economic Research Department Of Veterans Affairs

Tax Tip 2021 Advance Child Tax Credit Information For U S Territory Residents Tas

Top Ertc Experts Determine Your Eligibility With Free Quick Quiz No Obligation In 2022 Employee Retention How To Find Out Tax Credits